How To Guide For: Understanding The Difference Between An FHA Insured Loan Vs. A Conventional Loan

- Safi Bello

- Dec 28, 2016

- 1 min read

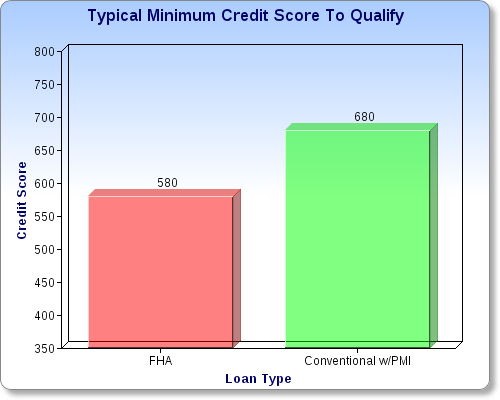

An FHA insured loan is a mortgage insured by the Federal Housing Administration. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan. Unlike conventional loans, FHA loans are government backed. Since FHA loans are insured by the government, they have easier credit qualifying guidelines than most lenders, as well as relatively low closing costs and down payment requirements. With an FHA loan you can pay a down payment as low as 3.5% of the purchase price, if you have a credit score of at least 580. The closing costs can be bundled with the loan. Now let's take a look at conventional loans. A conventional loan is a mortgage that is not guaranteed or insured by any government agency, including the Federal Housing Administration (FHA), the Farmers Home Administration (FmHA) and the Department of Veterans Affairs (VA). Conventional loans are typically fixed in its terms and rate. Conventional loans are ideal for borrowers with good or excellent credit. To get more in depth information on FHA insured loans vs. conventional loans click on the pictures below to read the articles.